No U.S. state has a carbon tax. An attempt to break through with a tax on carbon emissions in the state of Washington was defeated at the ballot in Nov. 2016, as we recount below. Nevertheless, Washington and 7 other states (including Washington DC, which for linguistic simplicity we are calling a state) are considered “promising” arenas for enacting state carbon taxes, in a comprehensive 2017 report by the Carbon Tax Center.

This page is sprawling, reflecting the intensity and breadth of state carbon tax organizing. These links can help you navigate:

- CTC report on state carbon tax potential

- Introduction to state carbon taxing

- The 2016 Washington state carbon tax referendum: what happened

- Carbon tax organizing in Oregon

- Carbon tax organizing in New York State

- Carbon tax organizing in Massachusetts

- Carbon tax organizing in Rhode Island

- Carbon tax organizing in Vermont

Also of interest: Minnesota state auditor Rebecca Otto has promised that her ambitious proposal for a revenue-neutral carbon fee will be a big issue in the 2018 campaign to succeed Mark Dayton as governor in 2018. Read our post, Minnesota state auditor stakes campaign for governor on carbon dividend.

CTC Report Ranks the States on Carbon Tax Potential

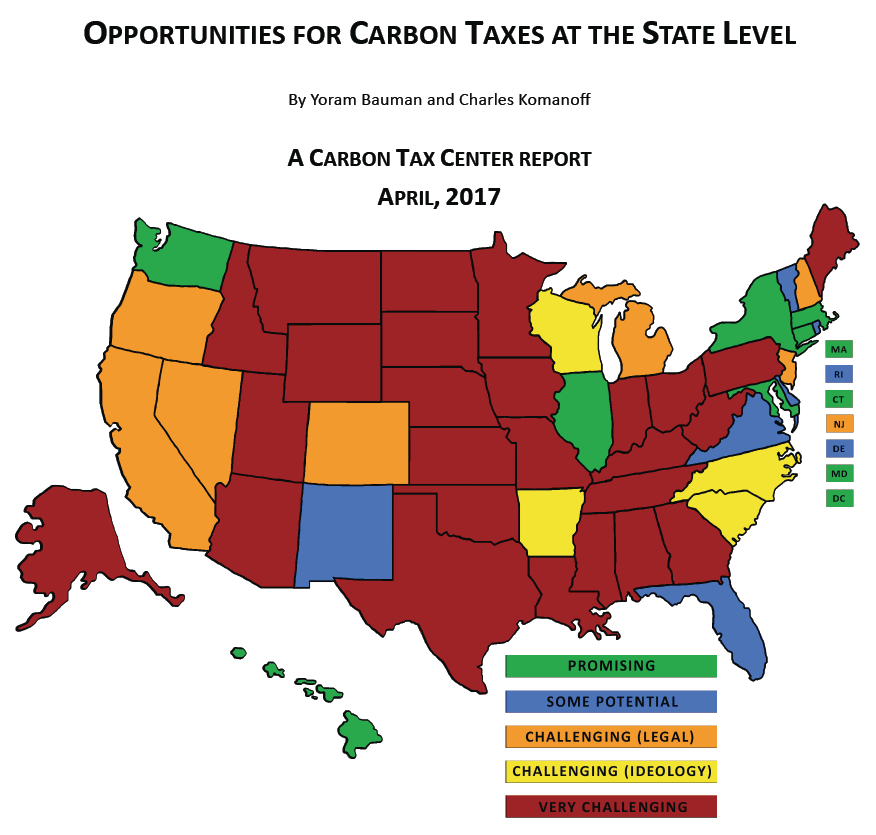

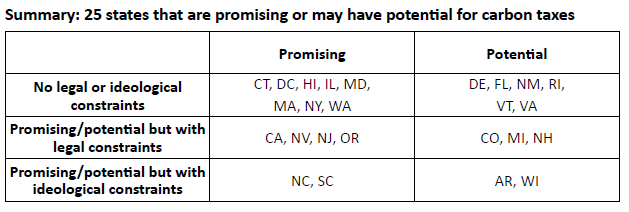

The report was written by Yoram Bauman, who spearheaded the Washington state carbon tax effort, and Carbon Tax Center director Charles Komanoff. It classifies the 51 states into five categories of carbon tax readiness ranging from “promising” to “very challenging.” (See map.)

Cover page of CTC’s new report rating the states’ carbon tax potential.

As the map shows, the eight most promising states are Connecticut, Hawaii, Illinois, Maryland, Massachusetts, New York, Washington and the District of Columbia. (Follow these links for historical perspective and other information on Massachusetts, New York, and Washington that isn’t in our new report.) We rate another 17 states as having “potential” for enacting state carbon taxes, with some having relatively clear paths while others appear to face legal or ideological constraints. (Follow these links for additional information on Oregon, Rhode Island, Vermont, and—as a bonus—the city of Boulder, Colorado.)

The other 26 states are a lot less promising. Our report explains why.

The rankings are just one aspect of the report. Each state gets an overview, a brief analysis of CO2 emissions, summaries of local climate impacts and current climate policies, a sketch of carbon pricing activism, a brief look at climate ideology and politics, recent polling results, and, where applicable, a summary of ballot measures and proposed legislation.

The report is comprehensive in its coverage but concise in each state’s analysis and ranking. It clocks in at 120 pages, making it huge (a 14 MB pdf), but it’s well worth perusing for info on your state and how it stacks up with others. Click here to download. (A reduced-size pdf under 2 MB is available for those with slower connections, click here.)

Further below is extensive coverage of the Washington state I-732 campaign and its aftermath, along with info on carbon tax organizing in five other states as well as Boulder, CO’s carbon tax on electricity generation. Click on those links and read our introduction for context.

Also see our August 2016 post reporting on the new Brookings Institution report, State-Level Carbon Taxes: Options And Opportunities For Policymakers. It’s essential reading for people seeking to advance carbon taxes at the state level and anyone who wants to understand the nuts and bolts of designing and implementing actual carbon taxes.

State Carbon Taxes: An Introduction

“It is one of the happy incidents of the federal system that a single courageous state may, if its citizens choose, serve as a laboratory; and try novel social and economic experiments without risk to the rest of the country.” — Justice Louis D. Brandeis (New State Ice Co. v. Liebmann, dissenting opinion, 1932)

This page covers organizing campaigns for U.S. carbon taxing at the state level, with sections on Washington State, Oregon, New York, Massachusetts, Rhode Island and Vermont.

With a national carbon tax blocked by the denialist Republican majority in Congress and a carbon-besotted White House, a growing number of climate advocates are heeding Justice Brandeis’s advice and are organizing at the state level. “Retail” politics, it is thought, might assuage concerns over outside-the-box ideas like carbon taxing, perhaps as occurred in the successful push for marriage equality (the right to same-sex marriage) which began and spread as state-level campaigns.

With a national carbon tax blocked by the denialist Republican majority in Congress and a carbon-besotted White House, a growing number of climate advocates are heeding Justice Brandeis’s advice and are organizing at the state level. “Retail” politics, it is thought, might assuage concerns over outside-the-box ideas like carbon taxing, perhaps as occurred in the successful push for marriage equality (the right to same-sex marriage) which began and spread as state-level campaigns.

Moreover, progressive and popular options for distributing carbon tax revenues can be made more tangible at the state level than the federal. This point was underscored by a Jan. 2015 study by the Institute for Taxation and Economic Policy ranking the 50 states on their tax incidence that established that states are more regressive taxers than the federal government. In particular, sales taxes could be swapped out for carbon taxes, as advocates in Washington State proposed in their I-732 ballot initiative in 2016 (full discussion further below).

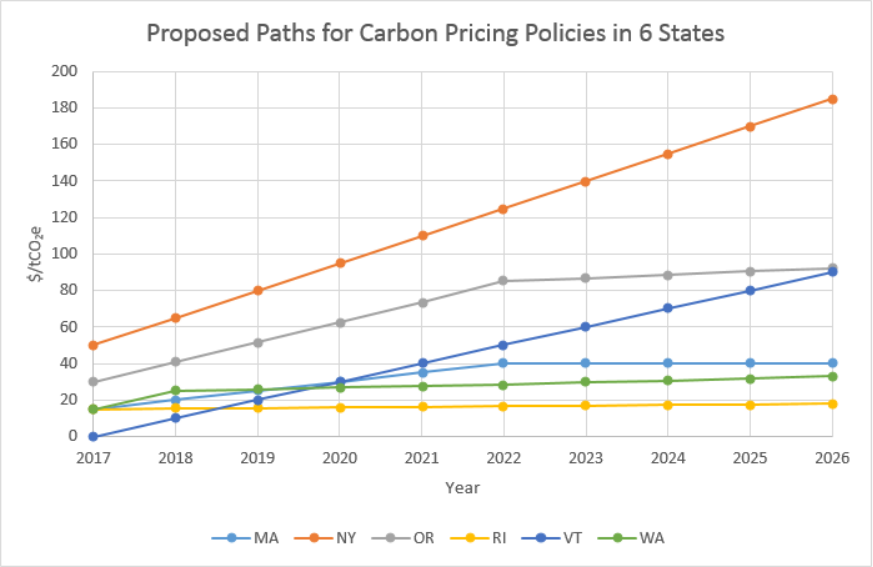

Not all states are riven by ideological resistance. While America’s geographical diversity can impede national unity, it has left some states less beholden to fossil fuel interests. Naturally, advocates are focusing on those states. (In March 2016, Resources for the Future posted two superb summaries of proposals in six states to adopt carbon taxes; the first focused on the tax rates (see graphic below), while the second addressed revenue treatment and household “incidence.”)

Graph courtesy of RFF. See link in adjoining paragraph.

States have also pushed the envelope on issues like minimum wage and fuel-efficiency standards, moving the national discussion as they did so. In a 2016 op-ed in the New York Times, Georgetown University law professor David Cole ascribed the National Rifle Association’s success at strangling national gun-control regulations to a decades-long campaign that changed state constitutions and laws to protect the right to possess and carry guns. Less far afield is the fact that gasoline taxes first took root in a handful of Western states to fund road construction, before spreading to the rest of the country. State carbon taxes could, it is hoped, create a similar template leading eventually to federal enactment.

The EPA Clean Power Plan may have provided an opening for state carbon taxes through a provision allowing states to submit projected emission reductions from carbon taxes applied to power generation (unfortunately, reductions from carbon-taxing non-electric sectors such as transportation would not receive credit). A June 2015 report from the Niskanen Center concluded that even small state carbon taxes could effectuate the required emissions reductions in most cases, mirroring our own modeling results on the national level.

Still, state carbon taxing raises issues that don’t apply to a federal tax. State policy makers and advocates need to address these concerns:

- Competitiveness: It would be hard for any one state to push its carbon tax too high, due to concerns over competitive advantage and inter-state “leakage” (e.g. driving out-of-state to fill up with untaxed gasoline).

Yet using some carbon tax revenues to reduce business taxes (as was proposed in Washington State) may soften concerns over economic impact. The cross-border issue may be less salient in larger Western states than in smaller East Coast states.

Jeff Renfro, a key member of a team at Northwest Economic Research Center that modeled a possible Oregon carbon tax, said:

We tried [in our modeling] to wreck the economy. We modeled a big tax – $100 a ton – with a relatively short phase-in period, and we assumed the government put the revenues toward non-productive reserves. Even in that scenario, we were surprised by how small the effects on employment were relative to the overall economy. (Interview with CTC researcher Matt Gordon, July 10, 2015)

- Efficiency: Energy policy is largely determined at the federal level. Administrative costs could be disproportionately higher for state taxes, due to greater cross-border movements of electricity and fuels among states than between the U.S. and other nations. In some states, utility sector regulation may complicate efforts to tax fossil fuels sufficiently upstream.

Many states already have taxes on gas and electricity, however, and it shouldn’t be difficult to piggyback a carbon tax on those taxes without significantly increasing administrative burdens. British Columbia’s carbon tax program uses this technique, and reports the administrative burden as negligible.

- Coverage: Only a national carbon tax will enable the U.S. to impose Border Adjustment Taxes to induce China and other countries to adopt their own taxes, which is a key benefit of pursuing carbon taxing. States cannot pursue a similar strategy without violating the commerce clause of the Constitution.

Although states may not tax imported goods, that prohibition shouldn’t be construed to mean they can’t tax imported electricity or fossil fuels that are then used within the state. In fact, some advocates see this as an opportunity for economic development; carbon-taxing out-of-state fossil-based electricity and fuels could stimulate growth in local renewables and energy-efficiency industries.

- Local Policy: Every state has idiosyncracies. In Oregon, the constitution mandates that all revenues from taxing gasoline must be deposited in the Highway Trust Fund. In Washington, state law precluded carbon tax revenues from being used for dividends to the public. Yet this patchwork of state policies may be a motivating factor in driving a national policy. The complications of doing business in jurisdictions with varying policies have even driven some oil companies to demand more unified action on climate change.

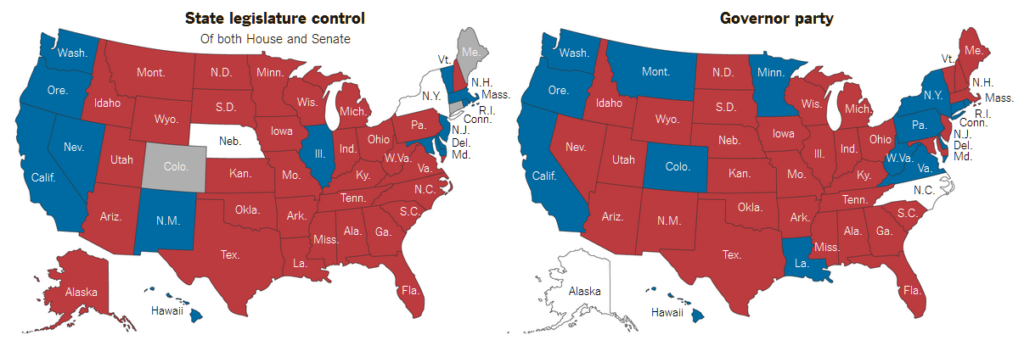

That said, the 2016 elections further cemented the Denier (Republican) Party’s hold on state governments, as the New York Times graphic below illustrates.

Republicans hold control of the governor’s office and the legislature in 24 states, while Democrats have that status in only six, according to this New York Times graphic.

On the other hand, red states tend to be fossil fuel-dominated states already out of reach of state carbon-tax campaigns. Two states with past or present carbon tax organizing, WA and OR, have Democratic governors and legislatures. Two others, NY and CO, have Democratic governors but divided or uncertain legislatures. Massachusetts and Vermont have Democratic legislatures but Republican governors.

The 2016 Washington state carbon tax referendum: what happened

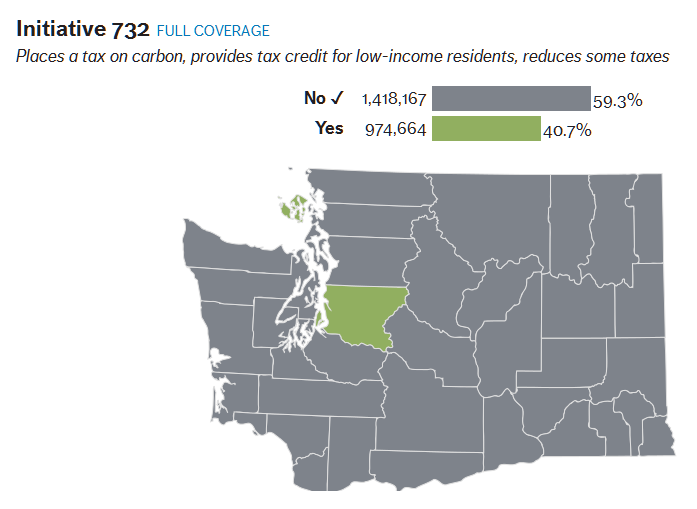

In 2015, grassroots advocates in Washington crafted a carbon tax ballot measure that, they hoped, would make theirs the first U.S. state with a carbon tax. Their Initiative 732 would have established a comprehensive statewide carbon tax reaching $25 per metric ton of CO2 in 2018 and rising thereafter at 3.5% faster than the general inflation rate. The initiative was decisively defeated, however, by a vote of 59% to 41%. We discuss I-732 and the divisiveness it spawned, directly below.

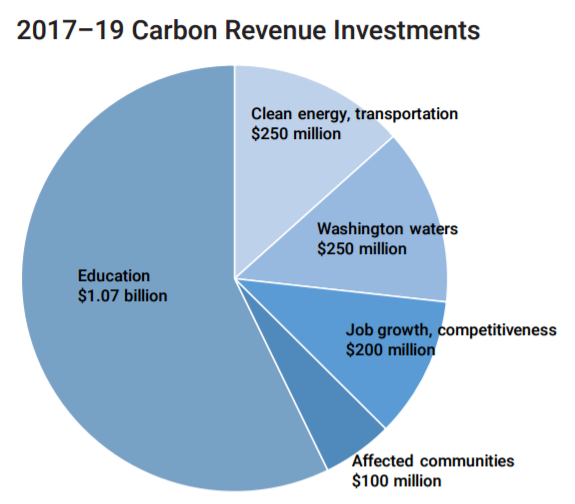

Washington Gov. Inslee’s just-proposed (Dec. 2016) carbon tax would dedicate a majority of revenue to funding education.

Five weeks after that vote, Washington Gov. Jay Inslee proposed a carbon tax whose level — starting in May 2018 at $25 per metric ton of CO2 and increasing thereafter at 3.5% a year faster than inflation — would be identical to that in I-732. The Seattle Times first reported the proposal, which is a key part of the governor’s fiscal plan, on Dec. 13. Inslee’s office has issued an informative 3-page policy brief outlining the intended uses of the carbon tax revenues; unlike I-732, which was designed to be nearly 100 percent revenue-neutral, the governor’s proposal, which requires legislative approval, is intended to patch big holes in the state budget. We hope to report on the progress of Gov. Inslee’s proposal shortly.

On Nov. 12 Carbon Washington, the grassroots advocacy group that gathered 360,000 signatures to put Measure I-732 on the November ballot, and then fought for its passage with a high-energy organizing campaign, issued a statement, Carbon tax friends, be proud of what we’ve accomplished. Here’s the opening paragraph:

Together, we accomplished something historic by putting the nation’s first statewide carbon tax before the voters. We showed that there is a strong desire for common-sense climate action in Washington State, and we influenced the national conversation on climate policy. We ran an honest, transparent, and positive campaign focused on addressing the climate and equity problems facing our society. We did all of that thanks to you.

CarbonWA says it is thinking through next steps and want[s] to hear supporters’ “thoughts on the election and where this movement that you helped build should go next.” The group invites feedback via email. Their terrific Web site, Yes on 732, is still up.

Seattle Times graphic, downloaded Nov. 11. Earlier reports had the vote slightly closer. Official Nov. 13 update (see text) has same percentages.

As of Nov. 13, Washington’s Secretary of State was reporting 1,571,080 No votes vs. 1,091,626 Yes, a nearly 3-to-2 margin. Only King County, the state’s largest, which includes Seattle, voted majority Yes; all other 38 counties voted No to Measure 732.

In the aftermath of the election, the Alliance for Jobs and Clean Energy — the Washington confederation that became the locus of “green” opposition to I-732 — posted a five-page draft clean energy plan intended to fulfill its commitment to fashion an alternative policy to Carbon WA’s revenue-neutral carbon tax. The plan’s carbon tax, just $15 per ton of CO2 and with no increase beyond inflation unless as-yet-unspecified reduction targets are met, would be around half of the tax level specified in I-732; most emission reductions would come from investments in efficiency and renewables outlined but not specified in the draft. Alliance leaders pledged to push their plan to the legislature and vowed to put it on the ballot in 2017, if necessary, the Seattle Times reported on Nov. 12.

Top reads on the ballot battle (newest listed first):

The I-732 referendum received intense national as well as local coverage in the run-up to the election, in part because the split over the measure within the green movement made for a compelling (and disturbing story).

The best post-mortem we’ve seen is Marianne Lavelle’s Nov 9 story, Washington State Voters Reject Nation’s First Carbon Tax, for Inside Climate News. It’s an excellent overview of the competing perspectives of I-732 proponents and opponents (state purview vs. national, social-justice vs. economic, etc.) and has quotes from Washington social-justice advocates (who opposed the measure) and climate luminary James Hansen and CTC director Charles Komanoff, who supported it. Here, for example, is a quote from KC Golden, senior adviser to the Washington State nonprofit Climate Solutions:”

The people who came up with the idea of ‘revenue-neutral’ did it for a good reason, to defuse the partisan bomb that keeps us from getting everywhere on climate. But we can’t find any political ‘there’ there. To tell labor and communities of color, ‘We’re going to change the incentives and benefits are going to flow’ sounds…a lot like ‘trickle-down’ economics. They justifiably don’t trust that story.”

Draw your own conclusions.

Here are half-a-dozen other (pre-election) articles:

- The left’s opposition to a carbon tax shows there’s something deeply wrong with the left, (Washington Post editorial, Oct 27). Strongly supported I-732 and decried left-greens’ stance that “softening the blow for the poor and middle class is not enough; the government must divert the revenue according to the wishes of specific interest groups.”

- Opposition to Washington’s historic carbon tax initiative is coming from the unlikeliest of sources (Natasha Gelling in Think Progress, Oct 6). Sophisticated and concise examination of the green split over I-732.

- Initiative 732: A ‘Carbon Tax Swap’ To Address Climate Change (Seattle NPR affiliate KNKX-FM, Oct 3). Excellent account of both sides’ views on I-732.

- The environmental groups killing a carbon tax (“The Hill,” Sept 22). Professor of law and economics Shi-Ling Hsu — a signatory to CTC’s Paris letter last fall — dissected the opposition to I-732 from sectarian green groups.

- Tax carbon polluters, not working families (“Crosscut,” Sept 20). Three veteran organizers explained why the I-732 carbon tax will be just as well as efficient.

- Washington Carbon Tax Ballot Initiative Picks Up Biggest Corroboration Yet (CTC blog, Aug 5). Our quick guide to Sightline Institute’s in-depth analyses backing Carbon-WA’s claims for Measure 732 demonstrating that the carbon tax will be revenue-neutral, income-progressive and climate-effective.

- There’s a cheap, proven fix to the world’s biggest problem (CNN, April 19). Political writer John Sutter interviewed Carbon-WA founder Yoram Bauman and explained why a victory for Yes on 732 could be key to unlocking carbon taxing in the U.S.

Our blog posts on I-732 (newest listed first):

The Carbon Tax Center strongly supported Carbon WA’s initiative and organizing campaign. Our blog posts during the few weeks before the election responded vigorously to attacks on Initiative 732. Earlier-dated posts mostly involved straight reportage about the merits of the initiative and the campaign to pass it.

- Naomi Klein Is Wrong On The Policy That Could Change Everything, Nov. 7, 2016. The policy that could do the most to start changing everything is on the ballot in Washington state, but somehow it’s not quite good enough for the author of “This Changes Everything.”

- To The Left-Green Opponents of I-732: How Does It Feel?, Nov. 4, 2016. The Koch brothers just gave $50K to the “No On 732” forces. If you’re on the left, it’s time to ask yourselves, in Bob Dylan’s words, “Are you having a good time?”

- Fighting in the Trenches Doesn’t Excuse Ignorance on Carbon Taxes, Oct. 28, 2016. We skewer criticisms of I-732 from the advocacy group Food & Water Watch, including their nonsensical claim that “carbon taxes help fossil fuel companies, not the environment.”

- Washington State’s I-732: A Climate Measure for the Society We Have, Oct. 18, 2016. Invokes mid-century humanist radical Paul Goodman to critique “old-guard” green-establishment’s stance opposing Carbon Washington’s ballot initiative.

- The Political Meltdown That Could Save The Climate, Oct. 8, 2016. Why the GOP-Trump electoral meltdown opens a path for I-732 to become the template for a U.S. carbon tax.

- Carbon Tax Can Be a Remedy for Toxic Hot Spots (Sept. 13, 2016). Rebuts notion — left over from the 2009 Waxman-Markey bill built around cap-and-trade with offsets — that a carbon tax could perpetuate or exacerbate tosic “hot spots” in communities of color.

- Washington Carbon Tax Ballot Initiative Picks Up Biggest Corroboration Yet, Aug. 5, 2016. Reports on masterly rebuttal to WA state government’s objections to I-732, from Pacific NW think tank extraordinaire Sightline Institute.

- Feeling The Heat: A Carbon Tax Gains Grassroots Momentum in Washington State, July 16, 2015. CTC’s Matt Gordon captures the on-the-ground energy of Carbon WA’s petition-gathering for Initiative 732.

I-732 history and details (This pre-Nov 2016) content has not been updated.)

The Evergreen State is blessed with abundant natural beauty — Mt. Rainier, the North Cascades, Puget Sound, the Olympic Peninsula and the Columbia River basin and gorge — with an outdoor culture to match. It was also wracked by drought and forest fires in 2015. In that year, carbon tax advocates under the banner of Carbon Washington began organizing for a ballot initiative mandating a state carbon tax. Measure I-732 would have taxed carbon emissions at an initial rate of $15 per ton of CO2, rising the following year to $25 per ton, and then increasing annually by 3.5% more than the inflation rate.

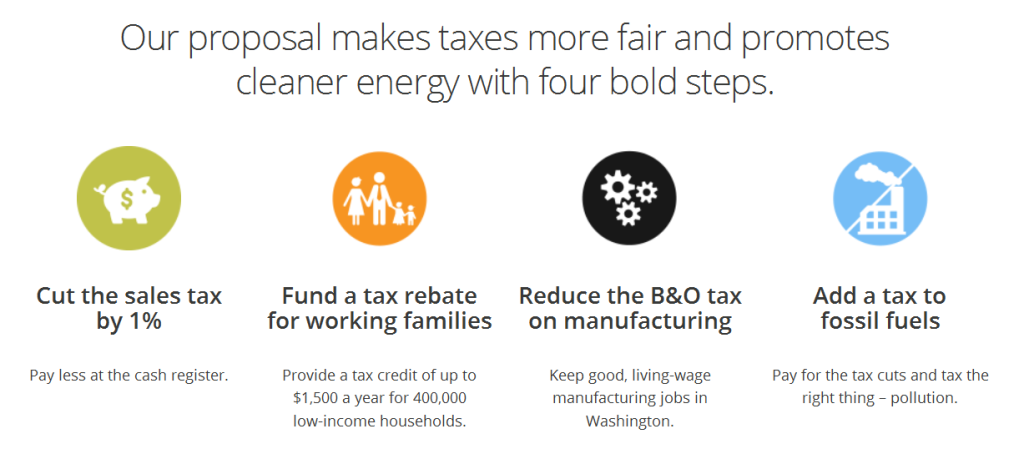

Graphic from http://yeson732.org/ highlights the tax benefits.

The tax, gracefully summarized last year by the Christian Science Monitor, would have used the expected $1.7 billion in annual revenue to overhaul Washington’s unusually regressive tax code. Most of the money was earmarked to lower the state sales tax from 6.5% to 5.5%. (While the state sales tax is 6.5%, the average combined local-state sales tax rate is 8.89%, the fifth highest in the country.) The annual increases in the carbon tax would have offset the rising value of the sales tax reduction, ensuring the measure stayed revenue-neutral. Another $200 million a year would have funded the state Working Families Rebate – an extension of the federal Earned Income Tax Credit. The Working Families Rebate was created in 2008 but never funded, and revenue from the carbon tax could have assisted 400,000 low-income working families. These two pieces made I-732 the state’s most progressive tax initiative since groceries were exempted from sales taxes in 1977. The remaining funds would have enabled the state to eliminate the business and occupation tax on manufacturing — a feature designed to win business support.

CTC researcher Matt Gordon visited Washington in June 2015 and met with ballot organizers there. He wrote a blog for us about Measure I-732 last July and another in August about backbiting against Measure I-732 by some veteran state environmental advocates. (The surprising opposition to I-732 was criticized by leading right-of-center economist Greg Mankiw in a New York Times opinion piece in early September, 2015, backing the measure.) Despite the opposition, Carbon Washington collected 360,000 petition signatures — over 100,000 more than the 246,000 required to put Measure I-732 on the November, 2016 ballot for a statewide up-or-down vote.

Keibun Mori, a former economist with the Washington State Energy Office, developed a carbon-tax spreadsheet model to predict revenue generation and CO2 reductions for the state from a carbon tax. Keibun’s model used an elasticity-based approach (as does CTC’s national carbon-tax model), and was used to estimate greenhouse-gas emission reductions for the Oregon study noted above.

The Carbon Washington website has clear and compelling information, arguments and graphics for Measure I-732, including lead organizer Yoram Bauman’s clarion defense of the measure’s provisions to ensure social and economic justice. Yoram’s New Year’s 2016 update was stirring and informative as well. Sign up with Carbon-WA to stay connected and donate.

Carbon tax organizing in Oregon

The Beaver State is the locus of the most detailed examination of a carbon tax for any U.S. state to date. Oregon’s legislature allocated $200,000 to study the effects of a state-wide carbon tax. The result was Carbon Tax and Shift: How to Make it Work for Oregon’s Economy, by economists at Portland State University’s Northwest Economic Research Center, and released in March 2013. The clearly written and gorgeously designed 36-page report examined a tax based on British Columbia’s carbon tax.

Like BC’s, the carbon tax examined for Oregon would be (largely) revenue-neutral: one scenario applied 70% of the tax revenues to cut corporate taxes, 20% to cut personal income taxes, and 10% to reinvest in industrial energy efficiency programs. The other scenario apportioned 50% of the revenues to cut corporate taxes, 25% to cut personal income taxes, and 25% for industrial and residential energy efficiency and transportation infrastructure.

The Oregon tax, starting at $10/ton of CO2 and rising by $10 per year to $60/ton, or roughly twice the level of BC’s tax, would, by 2025, reduce the state’s greenhouse gas emissions by 12-13% below baseline projections and generate over $2 billion a year in revenue, according to the report. The carbon tax outlined in the study became the basis of HB 3252, a bill aimed at establishing a state-wide carbon tax. The grassroots movement to advance the tax was led by Oregon Climate, which spread awareness via canvassing, tabling and lobbying. Oregon Climate also sought to bridge art with climate advocacy, culminating in “Salmon at the Redd,” a community project in which residents created tiles for a mosaic illustrating what they loved about their state.

Unfortunately, the carbon tax campaign was effectively pre-empted by Senate Bill 1547, which in 2016 established a Renewable Portfolio Standard mandating that Oregon utilities ramp up wind and solar facilities to supplement the state’s considerable hydro-electric supplies. Oregon Climate has shifted its focus to a national effort to help other localities advocate for carbon pricing.

Carbon tax organizing in New York

New York should be a strong venue for pursuing a state carbon tax. In October 2012, Superstorm Sandy made a climate-change believer of Gov. Andrew Cuomo. who declared, “[C]limate change is a reality, extreme weather is a reality, it is a reality that we are vulnerable,” after the tidal surge from the storm inundated coastal communities and brought unprecedented devastation to hundreds of miles of shoreline. Moreover, not just coastal residents but upstate citizens politicized by fracking have rallied around the Jacobson-Delucchi “100% Wind, Water and Sunlight” global scenario for NY State, as Jacobson and co-authors propounded in their compelling journal article in Energy Policy.

Two Carbon Tax Center officers — director Charles Komanoff and board chair Alex Matthiessen — outlined the rationale for and distributional impacts of a potential $20/ton (of CO2) NY State carbon tax in a 2013 op-ed for the Huffington Post (cross-posted here). Our draft brief envisions applying the lion’s share of carbon tax revenues to reduce the statewide sales tax rate by a full percentage point — paralleling the sales tax cut in Carbon Washington’s Measure I-732, discussed above. “Leftover” revenues could help fortify the state’s infrastructure to withstand future storms and/or expedite and incentivize homeowners’ and business owners’ installation of photovoltaic electricity generating capacity. Comments on this concise (6-page) draft document are welcome

A NY State carbon tax bill with a more aggressive design was introduced in Sept. 2015 by two Democratic legislators, Assemblyman Kevin Cahill of Dutchess County and Sen. Kevin Parker of Brooklyn. Their bill, A8372 Cahil / S6037 Parker, starts taxing CO2 emissions from coal, oil, natural gas and biofuels at $35 per ton and increases the rate annually by $15/ton, to a ceiling of $185 per ton. The bill proposes returning 60% of revenues to low- and moderate-income households, with the remaining funds used to prepare for climate change, invest in renewable energy, and build transportation infrastructure.

Environmental advocates from around New York State including CTC director Charles Komanoff met at the SUNY New Paltz campus in September, 2015 to discuss climate campaigning and carbon tax organizing. One of the participants, New York League of Conservation Voters Member Andrew Ratzkin, previously outlined the case for a NY State carbon tax in this compelling op-ed in Crain’s New York Business, in July, 2015. In mid-2016 Ratzkin published a lengthy article in the Columbia Journal of Environmental Law, You Say You Want a REV Solution, critiquing the state’s “Reforming the Energy Vision” blueprint as inferior policy to a statewide carbon tax.

Carbon tax organizing in Massachusetts

The bay state’s Global Warming Solution Act of 2008 mandated a 25% reduction of CO2 emissions below 1990 levels by 2020 and an 80% reduction by 2050. Befitting its “promising” status in CTC’s report, Opportunities for Carbon Taxing at the State Level, Massachusetts is a hotbed of advocacy for a statewide comprehensive carbon tax to meet and surpass those targets.

The most politically popular bill appears to be S.1821, An Act combating climate change, sponsored by State Senator Mike Barrett (D-Lexington). Barrett’s nearly identical 2016 bill S.1747 had 47 co-sponsors, and this year he has 64, nearly one-third of the legislature,

The Barrett bill specifies an initial carbon fee of $10/ton of CO2, increasing in $5/ton annual increments to $40/ton, after which the legislature will consider increases or decreases. The bill establishes a fee-and-rebate system, with 100 percent of carbon revenues collected from fossil fuel providers returned pro rata to state residents and to employers based on the number of employees.

S.1821 will direct additional rebates to households in car-dependent areas and to energy-intensive businesses. As with the similar Citizen Climate Lobby fee-and-dividend proposals at the federal level, the rebate system is intended to be income-progressive (with low- and moderate-income households being net beneficiaries while wealthier households would be net payees) while preserving all households’ incentives to reduce fossil fuel use in order to pay less in fees.

Supporters of Barrett’s prior bill, S.1747, cited broad support from businesses including financial services, healthcare, hospitality, food services, transportation, design and technology companies touting its potential to incentivize innovation and preserve competitiveness. At an Oct. 2015 legislative hearing, Business Leaders for Climate Action released an endorsement letter backing the Barrett bill, signed by over one hundred state businesses and business leaders.

Reports by the Massachusetts Department of Energy Resources and Regional Economic Model Inc concluded that S.1747 would slash emissions while boosting employment and overall economic activity.

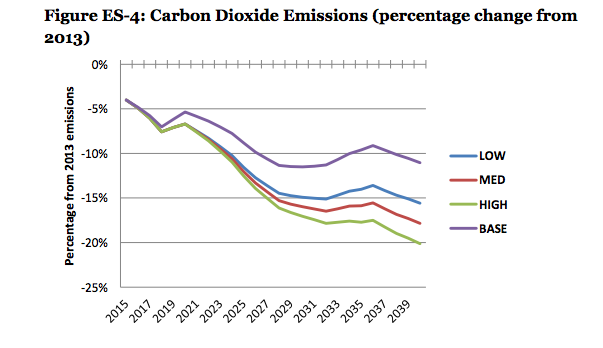

Projected Emissions After Imposition of $5/ton Carbon Fee, rising $5/yr to $40 (Prepared for Massachusetts Department of Energy Resources)

On the House side, State Representative Jennifer Benson (D-37th Middlesex) is sponsoring H.1726, “An Act to promote green infrastructure, reduce greenhouse gas emissions, and create jobs.” The Benson bill adheres to the Barrett bill’s carbon-fee-and-rebate model but dedicates 20 percent of revenues to fund green infrastructure directly, such as public transportation, renewable energy, energy efficiency, and protection against the expected impacts of climate change. With 80 percent of revenues applied to rebates rather than 100 percent, the Benson bill would likely have a somewhat less income-progressive outcome than the Barrett bill, though the difference would be attenuated by the green investments.

Two other energy-related bills also include carbon pricing provisions:

- Senator Marc Pacheco (D-Taunton)’s S.479, An Act relative to 2030 and 2040 emissions benchmarks, would authorize the state to “create, expand, or join market-based compliance mechanisms, including but not limited to greenhouse gas emissions trading and carbon pricing programs,” in order to achieve the greenhouse gas emissions reductions required by the Massachusetts Global Warming Solutions Act.

- Solomon Goldstein-Rose (3rd Hampshire)’s HD.1948, An Act relative to creating energy jobs, would establish a carbon-fee-and-rebate system similar to those in the Barrett and Benson bills as part of a larger initiative to make Massachusetts “the Silicon Valley of the new energy economy.”

Analysis by the Massachusetts Department of Energy Resources suggests that carbon pricing would deliver the greatest CO2 reductions of any policy while enhancing state and local employment. Advocates are using those findings, along with the potential to cut health care costs through reduced air pollution, to convince Governor Charley Baker to support carbon pricing legislation.

In Jan. 2017, Dave Anderson of the Massachusetts-based Energy & Policy Institute posted a provocative, well-documented piece, Under Rex Tillerson, ExxonMobil Lobbied Against Carbon Tax Bills. In his article Anderson revealed 2016 lobbying disclosures filed with the Secretary of the Commonwealth of Massachusetts indicating that a lobbyist paid by ExxonMobil opposed the revenue-neutral carbon tax bill S.1747, as well as other climate-related bills.

For more information on carbon pricing in Massachusetts, view this short video on carbon pricing by Business Leaders for Climate Action, or contact info@blcama.org.

Carbon tax organizing in Rhode Island

With its coastline-defined topography, the Ocean State is directly exposed to climate change impacts of rising sea levels, flooding and storms. Rhode Island is also home to U.S. Senator Sheldon Whitehouse, whose 100 weekly “Time to Wake Up” speeches on the Senate floor in 2013-2015 established him as Capitol Hill’s most forceful voice for climate action. The Senator’s American Opportunity Carbon Fee Act of 2014 would establish a national carbon tax.

Detail from REMI study of a Rhode Island carbon tax.

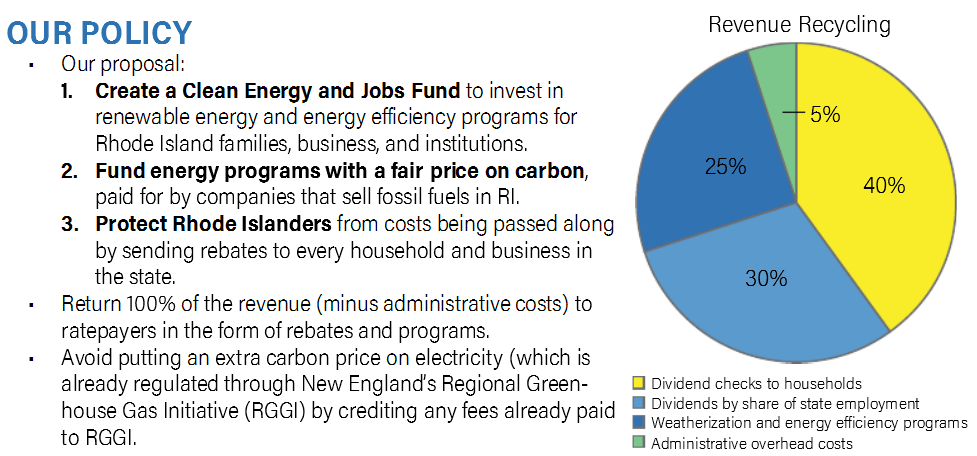

With federal carbon pricing blocked by the GOP, a coalition of RI environmental, faith and business groups formed Energize Rhode Island in 2015 to advocate for state carbon pricing legislation. In January 2016 State Rep. Aaron Regunberg (D-Providence) introduced House Bill 7325, along with 40 co-sponsors. H7325 specifies an initial carbon fee of $15/ton of CO2, increasing in $5/ton annual increments. Seventy percent of the revenue would be refunded via per capita and per employee rebates to Rhode Island families and businesses, with 25% invested in renewable energy and efficiency programs.

The Energize Rhode Island Coalition touts a REMI study finding that H7325 will create over a thousand new jobs in the first year alone — a major economic boost for a state whose 2014 population was just 1.055 million — while emission reductions quickly reach double digits. Job growth will continue apace in subsequent years, according to the study, as Rhode Islanders save much of the nearly $4 billion a year they now spend on fossil fuel energy, all of it imported from outside the state.

Carbon tax organizing in Vermont

The conversation among policymakers in Vermont has begun to shift from whether the state should price carbon pollution to how, reports Tom Hughes of VPIRG, in Feb 2016.

The carbon-pricing campaign is led by Energy Independent Vermont, a coalition comprising the state’s top environmental organizations, the renewable-energy leaders who have made Vermont a solar powerhouse, iconic Vermont businesses like Ben & Jerry’s and Seventh Generation, the state’s low-income weatherization agencies, interfaith religious leaders, and academics at U-Vermont’s Gund Center for Ecological Economics. Non-member allies of Energy Independent Vermont include the Vermont Council on Rural Development and a CERES-supported group of industry leaders including Sugarbush Resort, Burton and King Arthur Flour.

The campaign engaged Regional Economic Models, Inc. (REMI) to conduct an analysis of a pollution tax set at $100 per metric ton of CO2, with 90% of revenues recycled as cuts to the state income tax, corporate taxes and a reduction in the sales tax, and the remaining 10% reserved for low-income weatherization and other energy-saving investments. As modeled, the tax would exempt electric generation, since that is already covered with a carbon pricing regime through RGGI, the Regional Greenhouse Gas Initiative. The REMI study concluded that over the first decade this measure would cut carbon emissions from heating and transportation by 31% while generating 2,400 new jobs, raising gross state domestic product by $100 million, and adding more than $150 million a year to real disposable personal income.

Two bills with similar tax rates and revenue treatment were introduced in the Vermont General Assembly in early 2015, according to Hughes. Energy Independent Vermont delivered 25,000 petitions in favor of carbon pricing to Vermont legislators in November 2015, he reports. In January 2016 Gov. Peter Shumlin’s administration called for the state to “investigate and pursue options for market-based greenhouse gas emission policies.” A May 26 piece by Energy Independent Vermont activist Luc Reid in the Williston (VT) Observer, The unsuspected upsides of a carbon pollution tax, did a nice job of laying out the “income progressivity” of EIV’s carbon tax proposal.

The November election win of Republican Lieutenant Governor Phil Scott to the governor’s office will set back efforts to enact a Vermont carbon tax, Seven Days political columnist Terri Hallenbeck reported in early December.

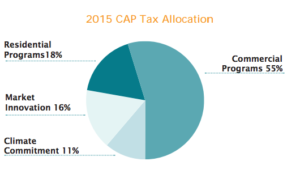

Boulder (Colorado)

The municipality implemented the United States’ first tax on carbon emissions from electricity, on April 1, 2007, at a level of approximately $7 per ton of carbon dioxide. According to the City of Boulder, the tax was costing the average household about $1.30 per month, with households that use renewable energy receiving an offsetting discount. The city expected the tax to generate about $1 million annually until its expiration in 2012, with the revenues used to fund Boulder’s climate action plan to further reduce energy use. In June 2009, the City Council voted unanimously to raise the tax level. Although the new rate was not originally specified, the expected increase in revenues, some $810,000 annually, suggests that the increase is on the order of 80%, or perhaps $5-$6 per ton of CO2 (on top of the original $7/ton). In 2012, residents voted to continue the tax at the 2009 rate for another five years.

Other States?

Please send us (info@carbontax.org) your reports, or even just ideas, on state-level carbon taxes, so we can post them here.