As the U.S. president holds the world hostage to his impending decision to accept or repudiate the Paris Climate Agreement, it’s worth noting that the United States could meet its Paris emissions pledge by adopting a Republican-branded carbon tax proposal.

That’s the so-called Baker-Shultz carbon tax devised by the Climate Leadership Council and released in February by a team of Republican luminaries headed by Reagan Secretary of State George Shultz and George H.W. Bush Secretary of State James Baker. The CLC proposal, dubbed “The Conservative Case for Carbon Dividends,” would tax U.S. CO2 emissions from fossil-fuel combustion at $40 per ton and return the revenues in equal shares to American families (thus the “dividends” in the proposal’s name).

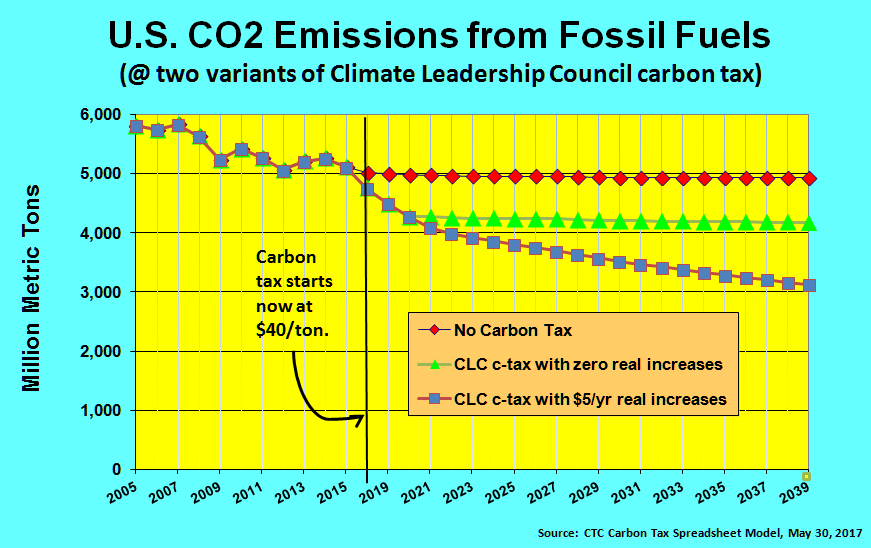

The vertical distance from actual 2005 emissions (5,812) and projected 2025 emissions with the green triangle (4,242) is 1,570, which is 27% of the 2005 amount (all figures in million metric tons of CO2).

As the Associated Press reminded us at the onset of the holiday weekend, “nearly 200 countries are part of the Paris accord and each set their own emissions targets, which are not legally binding. The U.S. pledged to reduce its annual greenhouse gas emissions in 2025 by 26 to 28 percent below 2005 levels, which would be a reduction of about 1.6 billion tons of annual emissions.”

With informed sources such as Inside Climate News and the New Republic insisting that Trump’s rescission of Pres. Obama’s Clean Power Plan puts our Paris target out of reach, we decided to run our carbon-tax spreadsheet model on the CLC proposal. The result was a bullseye: the model calculates that implementing an economy-wide charge of $40/ton of CO2 on U.S. coal, oil and gas combustion in 2018 would, by 2025, result in total CO2 emissions of 4,242 billion metric tons — a figure 27% less than 2005 baseline emissions of 5,812 billion metric tons. That’s smack in the center of our country’s pledge to reduce emissions by 26% to 28%.

Our numerical finding closely matches CLC’s own estimate of a 28 percent drop in emissions in 2025 vs. 2005 from the $40/ton CO2 charge. And while a majority of the forecasted reduction in emissions from today to 2025 would be in the electricity sector, the expected 45 percent share of reductions in the other sectors (passenger auto and air travel, freight movement, oil refining, etc.) is a big increase from those sectors’ 27 percent share of reductions from 2005 to 2015, reflecting the carbon tax’s power to reduce fossil fuels use more broadly than targeted regulations.

A few important details:

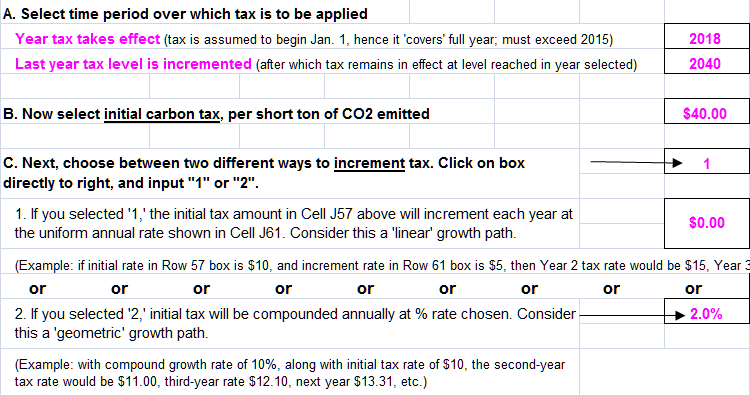

One, CLC’s modeling assumes a 2% per year real increase in the carbon tax following the initial startup at $40/ton. We’ve conservatively assumed zero increase, although our graph also shows a steeper reduction predicated on raising the initial charge by $5 per ton per year.

Two, our two curves coincide for the first few years and begin diverging only in 2021. That’s because we’ve built a “brake” into our model that limits the economy’s uptake of the carbon charge to a rate of $12.50 per ton per year; increases beyond that are carried over into future years. Thus, the full impact of the $40 initial charge imposed in 2018 isn’t felt until 2021.

You can input your own carbon tax rates into our model. This screen is on the spreadsheet’s Summary page.

Three, the U.S. Paris commitment of a 26-28 percent reduction applies to all greenhouse gases, not just CO2. But since non-CO2 GHG’s such as methane are considered to have more low-hanging fruit, on average, being able to achieve a 27% reduction in CO2 by 2025 should virtually guarantee hitting the target of 27% less greenhouse gases.

Note that we label the Baker-Shultz proposal “Republican-branded” rather than “Republican,” preferring to reserve the latter designation for current Republican office-holders. But it’s striking nevertheless that a carbon tax proposal advanced by erstwhile Republican icons — Messrs. Baker and Shultz held many other senior positions even beyond secretary of state — could enable the present Republican administration to meet our country’s Paris climate-protection targets, and to do so in a straightforward, non-regulatory, “market-friendly” fashion that was once considered a bedrock G.O.P. principle.

We’re updating our carbon-tax model to the latest (2016) baseline. Watch this space for its release in June.

ed phillips says

A normal person would see the wisdom in this proposal. What are the odds that POTUS will support this proposal. I would say slight.

Julie Prodani says

How about getting rid of animal subsidies instead.? By cutting animal agriculture subsidies not only do you lower carbon emissions significantly meeting the Paris emissions pledge but you also clean our waters, ocean, save the rainforest and our tax dollars significantly.

James D McGinn says

This is a great proposal and I would accept as is for sure. However, what about only half going to a rebate and the other half to the highway fund? As for the potus accepting it remember Ivanka and Jared are likely all for this and they could use this to bargain with dems and get a flat tax passed and thus change the IRS forever along with saving the environment!

Alan N. Connor says

When you tax emissions CO2 is still going into the atmosphere and significantly reducing the ppm. Instead of taxing emissions tax carbon upstream at extraction, points of input and ports of entry to reduce the amount of carbon that is emitted.

Michael O'Hara says

Alan, the CLC carbon tax does tax the fossil fuels at the point of extraction – the emissions are calculated based on typical carbon content of the material in question.

Wm peabody says

I would take anything over failing to meet our Paris agreement , but its hard to imagine that Paulson was not tried for betraying the trust of the american people in 2008. A bigger a$$hole one would take years to find. I am curious what is in it for that whore and all his greedy cronies. Again- I am sure that it is a setup to make ridiculous amounts of money for those advancing it, and if its the best we can get passed and still know that we meet our Paris agreement its better than the tradeoff that the american people got with the mortgage and bank lending. To all those who would take from others I pray there is a hell that they can rot in.