Last month’s Pricing Carbon Conference at Wesleyan U. featured a debate over three competing approaches for pricing carbon emissions, each of which is embodied in bills introduced in the 111th Congress:

- Cap-and-trade with offsets (essentially the Waxman-Markey bill);

- Cap-and-dividend (essentially the Cantwell-Collins bill); and

- A stepwise shift from payroll taxes to carbon taxes (essentially the Larson bill).

The Conference also offered a workshop comparing two ways to return revenues raised by a carbon tax or by selling carbon emission permits:

- a regular “dividend” or “green check” sent to all U.S. households; vs.

- a series of periodic reductions in payroll taxes.

Cap-and-Dividend proponent Peter Barnes, flanked by NRDC's Dan Lashof (left) and Carbon Tax Center's Charles Komanoff (right), at the Wesleyan Pricing Carbon conference.

As hoped, the Conference has sparked a flurry of substantive and strategic discussions. For example, cap-and-dividend advocate Peter Barnes is imploring us to align the Carbon Tax Center with the CLEAR cap-and-dividend bill introduced in December 2009 by Senators Cantwell (D-WA) and Collins (R-ME).

The CLEAR bill is backed by a coalition of largely grassroots organizations, who view it as a way to achieve a guaranteed reduction in emissions without the political compromises and anti-consumer aspect of cap-and-trade with offsets. We hold Peter and his coalition partners in high regard. Their cap-and-dividend concept is certainly a quantum improvement over the cap/trade/offset model that some of the mainstream environmental groups rode to defeat (again) in 2009-2010. Yet both the concept and the particulars of the CLEAR bill fall far short of what we at CTC believe is required in carbon-pricing legislation.

In this post, we contrast the CLEAR bill with the approach taken by Rep. Larson (D-CT) and 12 co-sponsors in their carbon tax bill, America’s Energy Security Trust Fund Act, which Mr. Larson pledged at Wesleyan to re-introduce in the new Congress that convenes in January.

The CLEAR Bill at a Glance

Like all cap-based bills, the CLEAR bill relies on a declining “cap” in the number of carbon emission permits to be auctioned to emitters. In CLEAR’s case, the promised decline (relative to 2005 emissions) would be 20% in 2020, 30% in 2025, and so forth, finally reaching an 83% drop by 2050. CLEAR would return 75% of the revenues from the permit auctions to all U.S. residents, with each getting an identical amount. The remaining 25% of revenue would be placed in a “Clean Energy Reinvestment Trust Fund” (CERT) for appropriation by Congress, ostensibly to “green energy” investments, mitigation, adaptation and transition assistance.

As a brake on price volatility, and to provide a modicum of price predictability, CLEAR sets a floor and ceiling on the prices of the carbon emission permits: the floor is set at $7 per ton of CO2 rising at 6.5% annually plus the rate of general inflation, with the ceiling at $21/ton, rising at 5.5% plus inflation. The floor is intended to protect investments in low-carbon measures by ensuring that fossil fuel prices include at least a minimum charge for their carbon emissions, while the ceiling is intended to shield consumers from too-rapid price rises. When the ceiling is hit, a “safety valve” in the CLEAR bill triggers auctions of additional permits at the ceiling price; the revenue from these supplemental permits is added to the CERT fund.

CLEAR’s Biggest Problem: Its Cap Hides a Much-Too-Low Price

The Carbon Tax Center has modeled the price levels needed to achieve particular emissions reductions. Our conclusion, using historical energy price-elasticity data, is stark: the CLEAR bill’s emissions reductions targets cannot be achieved within the bill’s low price ceiling. When we conveyed this finding at a meeting with Sen. Cantwell’s staff in early 2010, the response was even more stark: “We don’t intend to use (CO2) prices to reduce emissions.” — a statement that appears to deny the fundamental role of prices in driving changes in behavior.

The apparent disconnect between CLEAR’s emission targets and its price ceiling means that the ceiling price would be hit frequently, perhaps even continuously. This in turn would open the safety valve and cause the auctioning of supplemental emission permits, whose revenue would fund CERT. In effect, then, as the cap tightened, CLEAR would function like a low carbon tax (with the level set at the safety valve auction price), an increasing share of whose revenues would flow to the CERT fund. The initial promise of returning 75% of revenue would recede as the cap tightened and an increasing share of revenue went to the CERT fund. In this respect, CLEAR might even come to resemble the “Breakthrough” proposal for a low carbon tax to fund RD&D, albeit with less specificity about which technologies Congress might choose to subsidize and less clarity about the expected CO2 prices.

The apparent disconnect between CLEAR’s emission targets and its price ceiling means that the ceiling price would be hit frequently, perhaps even continuously. This in turn would open the safety valve and cause the auctioning of supplemental emission permits, whose revenue would fund CERT. In effect, then, as the cap tightened, CLEAR would function like a low carbon tax (with the level set at the safety valve auction price), an increasing share of whose revenues would flow to the CERT fund. The initial promise of returning 75% of revenue would recede as the cap tightened and an increasing share of revenue went to the CERT fund. In this respect, CLEAR might even come to resemble the “Breakthrough” proposal for a low carbon tax to fund RD&D, albeit with less specificity about which technologies Congress might choose to subsidize and less clarity about the expected CO2 prices.

The CERT Fund—Big Dogs Eat First, But Can They Reduce Emissions?

Needless to say, the same interests that wrote themselves free allowances under the Waxman bill would use their political muscle to divide up the CLEAR bill’s CERT fund. Thus, no one should be surprised if “clean coal,” ethanol and other “incumbent” energy interests garnered a lion’s share of the CERT fund’s supposed “clean energy investments.”

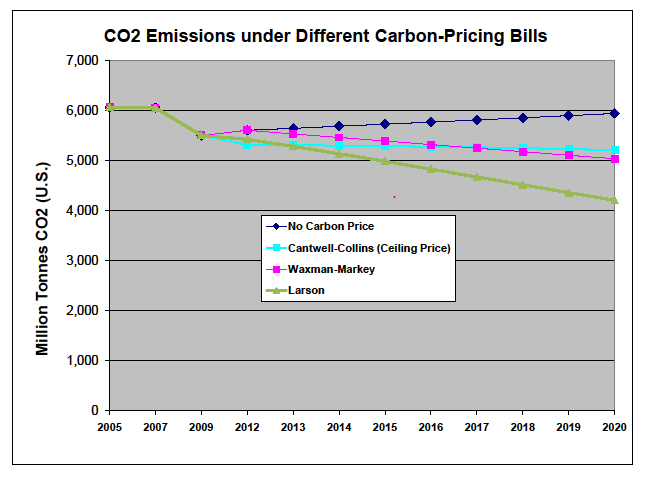

Nevertheless, CLEAR proponents appear to assume that the CERT fund would achieve near-miraculous reductions in carbon emissions. Our modeling indicates that because CLEAR’s price level is held so low, the bill would have to rely on the CERT fund to achieve more than half of its mandated 2009-2020 emissions reductions. Indeed, with its low (5.5%) annual increase rate, CLEAR’s $21 ceiling price would rise to only about $35 in a decade; that’s less than a third of the 2020 price in the Larson bill. No wonder Larson is projected to reduce emissions by 30% by harnessing the power of real price signals, whereas the CLEAR bill would have to rely on unspecified (and likely pork-laden) energy “investment” simply to achieve a reduction of 20%.

The Vast Costs of Hiding the Price

The main (political) appeal of a cap seems to be to hide the price. Yet hiding the price from investors and households guarantees that caps will be far less effective than direct pricing mechanisms at inducing investment in low-carbon energy and efficiency. The Brattle Group, a well-respected economics consultancy, studied the price volatility in the European Union’s Emissions Trading Scheme and concluded, first, that the noisy, hidden price signal there delayed investment in alternative energy by a decade; and, second, that the cap-derived CO2 price would have to rise roughly twice as high to get the same emissions reductions as an explicit tax.

Moreover, as we saw in the acrimonious and puerile debate over the Waxman bill, “hide the price” leaves everybody with an Internet link free to speculate on the cost of the legislation, with estimates ranging from astronomical (by those opposing action) to microscopic (by those claiming that “cost controls” such as offsets would avoid the need for significant CO2 prices). The result of “hide the price” in 2009-10 was a confused public and a stymied Congress. There’s no reason to expect a clearer discussion if cap systems continue to be the preferred way to price carbon emissions.

Hiding the price under a cap also complicates international harmonization. As we described in a post here in March 2009, and “Report from Copenhagen: Forget carbon targets, just set a price” an explicit carbon tax with border tax adjustments can be an effective incentive for other nations to enact their own carbon taxes to garner the tax revenue that their carbon-taxing trading partners will otherwise collect on imports at the border.

CLEAR’s Flimsy Wall Around Wall Street

The CLEAR bill seeks to avoid inducing speculative secondary markets by fiat: prohibiting entities that buy or sell emission permits from buying and selling carbon derivatives. It also would require CFTC, FERC and FTC to promulgate regulations on CO2 emissions trading. But as the Congressional Budget Office, Robert Shapiro and other economists have concluded: because of the energy industry’s need for insurance against wild price swings, the use of hedging instruments is unavoidable in the large and volatile CO2 markets that are inherent when setting a price indirectly using a cap. It appears inevitable that a secondary market would emerge overseas, if not illicitly onshore.

CLEAR’s Big Contribution: Revenue Return

The CLEAR bill did perform a great service by bringing revenue return via “dividends” into public discussion, at a time when Waxman-Markey proposed what amounted to a 40-year earmark of carbon revenues. (W-M would have allocated 85% of allowances, overwhelmingly to “incumbent” energy interests – effectively, a hidden, volatile and regressive tax.) CLEAR would at least start with 75% revenue return, although as discussed, that fraction would diminish as the cap tightened and the price ceiling was hit. Nevertheless, revenue return via a “dividend” or “green check” offers transparency and accountability that could help build political support for carbon emissions pricing.

On the other hand, returning revenue via reduced taxes on workers, as Rep. Larson proposes, would also avoid regressivity while offering the additional advantage of employment stimulus. This kind of tax-shifting seems to be a key ingredient in the continued political and economic success of the carbon tax in British Columbia and its effectiveness has been widely recognized here, too. Cutting payroll taxes has been praised by the Congressional Budget Office as one of the most cost-effective ways to reduce unemployment. The bipartisan “Hire Now” Act, co-sponsored by Senators Hatch and Schumer, effective in March 2010, eliminated the first six months of payroll taxes on employers that hire the unemployed.

While pro rata “dividends” offer appealing transparency and simplicity, the potential for a “job-creating carbon tax” to cut payroll taxes while de-carbonizing our economy seems no less attractive, particularly with officially-measured unemployment persisting above 10%. Though we conclude that CLEAR bill is too flawed to serve as effective carbon pricing legislation, it did at least jump-start the much-needed debate about revenue return. For that, Senators Cantwell and Collins and CLEAR’s supporters deserve high praise.

Photo: Wesleyan University

Dan says

There are two disadvantages to the Larson bill approach that I see. The retired population and others lacking W-2 income are not compensated under this approach. Given the clout of AARP and other interest groups, I think this would be difficult to sell. Second, the dividend approach allows for adjustments based on the carbon-intensity of electricity generation in specific regions. For example, if you live in a state with a high percentage of coal-generated electricity, your bills would go up far more than someone in the northwest whose electric bill wouldn’t change much (due to the high share of hydroelectric power). The dividend could be adjusted accordingly for these regional variations. This would make the dividend approach easier to sell politically.

Peter Barnes says

James Handley may be right that the price collar in CLEAR isn’t high enough, or he may be wrong. At this point we just don’t know. We also don’t know if the pre-set prices in the Larson bill are ‘right’ — they could be too high or too low. If they’re too high they could have undesirable economic consequences.

Fortunately, the CLEAR Act includes a fast-track adjustment mechanism that enables the president to recommend changes down the road, with Congress required to vote on the recommendations within 30 days. No filibusters permitted, and no super-majorities required. The idea is, let’s start the ball rolling with the right architecture — a steadily descending upstream cap and a steadily rising cash dividend — and if the cap is too high, or the price too low, adjust it later when there’ll be a large constituency favoring higher prices and dividends.

The main reason I prefer the CLEAR Act to Larson’s tax shift is the clear, transparent dividend, wired monthly to every American with a Social Security number. Everyone will know they’re getting monthly cash to compensate for rising carbon prices. As prices rise, so — automatically — will dividends, and a majority of Americans (including most of the middle class) will come out ahead financially.

By contrast, tax savings under a payroll-to-carbon tax shift will be almost invisible and not clearly linked to rising carbon prices. And the claim that it will create jobs is dubious. What is certain is that a reduction in payroll taxes paid by employers will result in huge windfalls to companies like McDonald’s and Walmart, without any proportionate rise in employment.

As I said at the Wesleyan conference, I would be happy to see enactment of a ‘fee and dividend’ system as proposed by Jim Hansen and others. But I feel strongly that use of the tax code for returning carbon revenue will not sustain popular support for rising carbon prices, and could result in unearned windfalls for large corporations.

James Handley says

Dan,

Larson’s bill returns revenue to all Social Security recipients through a credit on federal income taxes (thus it avoids tangling with the SS trust fund), but it does miss the unemployed which is a small and fairly easy fix that we’ve suggested.

Peter,

Larson’s payroll tax cut is to workers, not employers which means the bill wouldn’t enrich WalMart or McDonald’s.

Reducing taxes on the employee side may not be the best way to stimulate employment but it does raise the effective wage which should have stimulative effect. Some have suggested splitting the tax cut between employer and employee which strikes me as reasonable.

I agree that by skipping the sleight of hand involved using “caps” to set prices, “fee and dividend” is a whole lot better than “cap-and-dividend.”

– jh

Jeanne Fudala says

Shortly before I saw this article, I was doing a search and found the piece linked and excerpted below. Though the writer points out “the problems (some very serious)” she believes that the bill can become a good starting point if a fairly large number of things are addressed. I personally feel there’s too many things in this “cap and dividend bill, or more accurately, a cap and trade and dividend bill” (the author’s description)that need to be addressed and would be very time consuming. Better to start afresh —

with the simple and straightforward carbon fee and dividend–the Peoples Climate Stewardship Act proposed publicly by Hansen –the collaborative effort of a number of organizatons, including, of course, the Carbon Tax Center.

<> MORE

Jeanne Fudala says

The part of my post that excerpted the above-mentioned piece got cut off.

“How to Make CLEAR (Cantwell-Collins Cap and Dividend Climate Bill) A Good First Step?

Posted by maggie in Newswire, U.S. Legislation on 03 30th, 2010

S.2877 : Carbon Limits and Energy for America’s Renewal (CLEAR) Act

http://www.climatesos.org/2010/03/clear-cantwell-collins/

Following the disastrous House-passed Waxman-Markey bill, the Senate proposed Boxer-Kerry bill, (both are cap and trade bills that would do more harm to the environment than doing nothing at all, in the words of prominent climate scientist Dr. James Hansen), and now the Kerry-Graham-Lieberman bill still being concocted but already promising to be even worse, many people are understandably thrilled to hear about the Cantwell-Collins bill (acronym CLEAR) that purportedly removes many of the key problems in the Waxman-Markey cap and trade bill.

Of all the major advantages claimed by CLEAR’s proponents, only one, namely, that 100% of permits from the cap are auctioned instead of most of it given to polluters for free, is clearly uncontested. Another reasonable claim is that the carbon market is more closely regulated and restricted under CLEAR, but there are some who worry that the carbon derivatives market can still have significant destabilizing effects, especially once the carbon price has significantly risen after the initial years.”

Daniel Jones says

CTC writings emphasize that revenue collected through a carbon fee would be returned to people, thereby offsetting the additional expenses resulting from a fee.

However, if the fee succeeds in causing a shift to more expensive energy resources, the consumer’s additional expenses would not be offset by a dividend.

To illustrate – If we impose a fee of $50 per tonne of CO2 and that fee causes an increase in the price of coal-fired electricity from $60 to $110 per megawatt-hour, there are two possible outcomes.

First, we could go on using coal. We would pay $110 and get $50 back in dividends.

The second possibility is that we shift to renewable power costing about $100/MWh (I’m assuming that price in this illustration). In that case, there would be no dividend. The consumer loses (at least in the short-term traditional economic sense).

While it might be intuitively obvious that that solving climate change problems won’t be cheap, CTC’s constant emphasis on mitigating adverse consequences to consumers by returning dividends seems a bit misleading.

Are there reasons to believe that a tax or fee will not, in the end, increase energy prices in a way that leaves consumers poorer?

James Handley says

hi Daniel,

Important questions. Your example illustrates exactly the “substitution” effect (replacing fossil fuels with say, wind power) that a carbon tax is intended to induce. Revenue return is intended to obliterate the undesired “income” effect for all but the most profligate fuel users and to dampen it even for them.

Americans have vastly disparate carbon “footprints.” (See slideshow under “issues,” especially no 26, a pie chart showing the distribution of US energy use.) Because of this strong upward skew, returning 100% of carbon tax revenue equally to all adults would provide a net benefit or fully compensate everyone in the lower 2/3. (By comparison, if only 3/4 of revenue were returned as the CLEAR bill proposes, only about 1/2 of households would break even or better.)

Low carbon users, (say a transit rider or bicyclist who lives in an apartment or efficient house) would get more back than the increase in fuel-related costs induced by the carbon tax. Conversely, carbon hogs (heavy SUV drivers, frequent fliers who and live in McMansions) would pay more in higher costs than their revenue return. (See “Introduction,” esp. “Softening the impacts.”)

Because carbon charges will need to rise briskly for at least a decade, we advocate returning all or nearly all revenue to avoid income effects on the disadvantaged and middle class while steadily increasing everyone’s incentive to decarbonize. We’ve noticed that revenue return has helped build and maintain political support for British Columbia’s gradually rising carbon tax.

Alexis says

Hello! I could have sworn I’ve visited this web site

before but after browsing through many of the articles I realized

it’s new to me. Anyhow, I’m certainly happy I stumbled upon it and I’ll be bookmarking it and checking

back regularly!